🌱 Dow’s “Green Shoots” — or Just a Mirage?

- Emma Bassila

- Dec 18, 2025

- 2 min read

Dow’s Q3 earnings got Wall Street excited — the stock jumped 13% in a day, adding roughly $2 billion in market cap. Investors clearly saw something they liked. 👉 But is it real recovery... or just a mirage in the desert of this chemical downcycle?

💪 The Positives: “Control the Controllables”

Let’s give credit where credit is due.

Dow’s leadership did what strong management teams do in tough markets:

Cut the dividend early to protect cash.

Hit pause on a Mega Capital project.

Streamlined operations and started exiting loss-making assets in Europe.

Smart, proactive, and exactly what you’d expect from a seasoned operator.

⚙️ The Reality Check: Fundamentals Still Rule

But here’s the thing — what Dow can’t control is bigger than what it can.

Margins across the chemical chain are still under pressure.

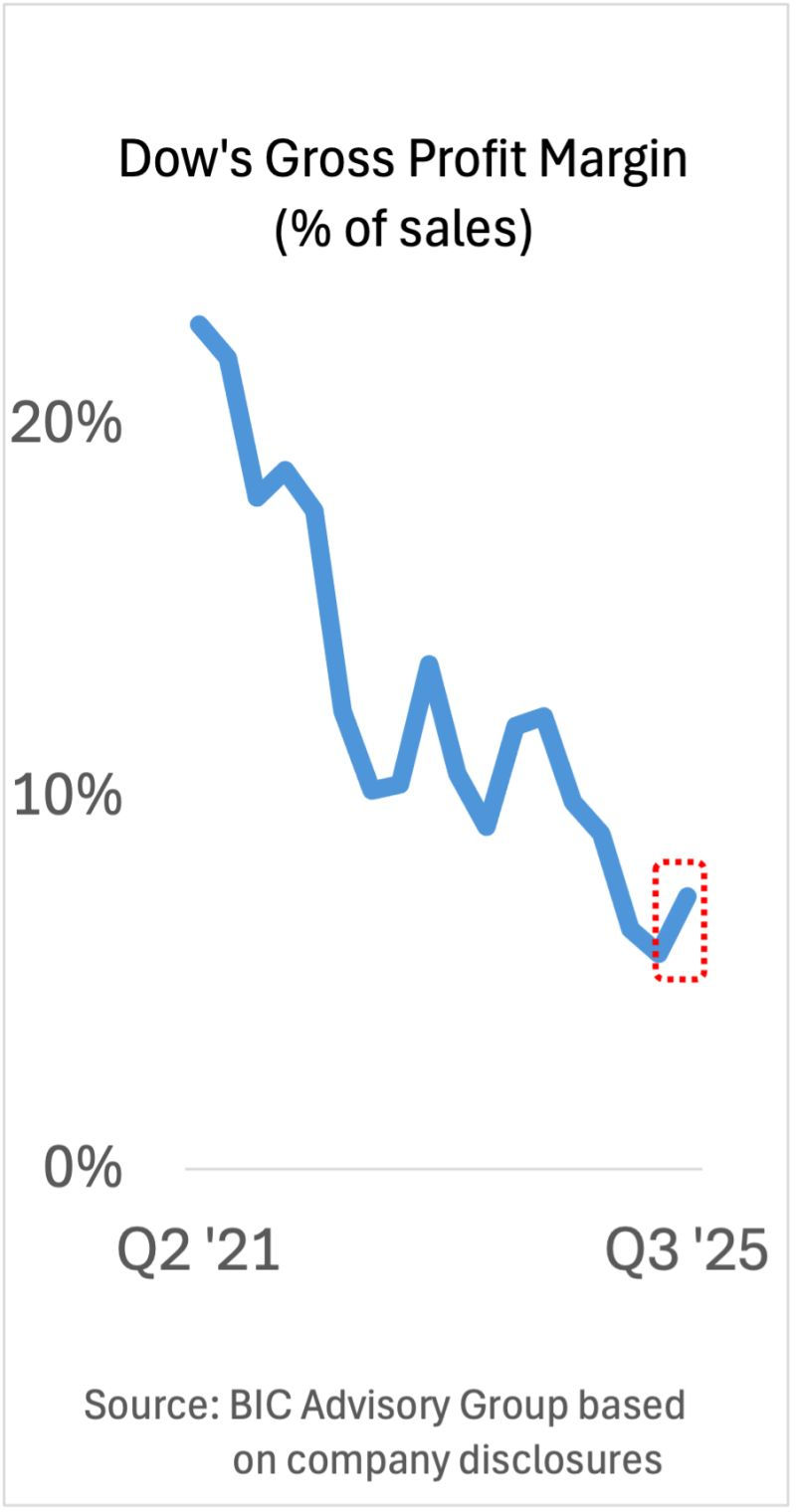

Dow’s gross profit margin trend tells the story: a small bounce in Q3 after four years of steady decline.

That’s not yet a turnaround. It’s a pause in a slide.

🔍 What’s Next: Q4 Will Be a Tough Quarter

Dow’s Packaging & Specialty Plastics unit — its main profit engine — drives about 95% of total earnings (on average over the last 3 years). Within that, North American polyethylene is the core business.

And right now, that market is soft.

Early price resets to secure 2026 domestic contracts are dragging Q4 prices lower. Expect the year’s low point in December, then a rebound in Q1.

🧭 Looking Ahead: No “Easy Button”

In a new BIC Advisory Group Executive Brief issued to clients this week, we laid out Dow’s strategic choices for navigating a long bottom-of-cycle.

Their recent actions are necessary — but not sufficient.

Tough portfolio calls are coming. There’s no quick fix this time.

Our take:

Dow’s Q3 looks slightly better — but the fundamentals haven’t flipped yet.

Investors may be seeing “green shoots,” but this soil is still hard and dry.

Earnings releases/calls coming up in the next few days from ExxonMobil, Chevron Phillips Chemical Company, LyondellBasell, Westlake and SABIC will bring more clarity. Stay tuned...

Comments