🏭 North America’s Petrochemical Investment: Losing Steam?

- Emma Bassila

- Dec 18, 2025

- 1 min read

Two headlines last week raised eyebrows across the industry: 1) Dow has paused its Net-Zero petrochemical project in Alberta for two years; 2) Shell is exploring the sale of its Pennsylvania petrochemical plant

These are flagship projects built on some of the world’s most advantaged ethane feedstock.

If they can’t clear the investment/ownership hurdle, it begs the question:

Are new petrochemical projects still viable anywhere in North America?

⛔ Headwinds Are Mounting:

📉 Demand stagnation — Plastic resin demand in the United States and Canada has grown just ~1% annually over the past 20 years, less than half of GDP. Any new capacity must chase lower-margin exports.

💰 High build costs — New complexes cost 1.5 to 2X more to build than in China.

⚖️ Policy uncertainty — Low carbon incentives under the Inflation Reduction Act are in flux, and Canada is likely to mirror any rollback—undermining the economics of Net-Zero projects.

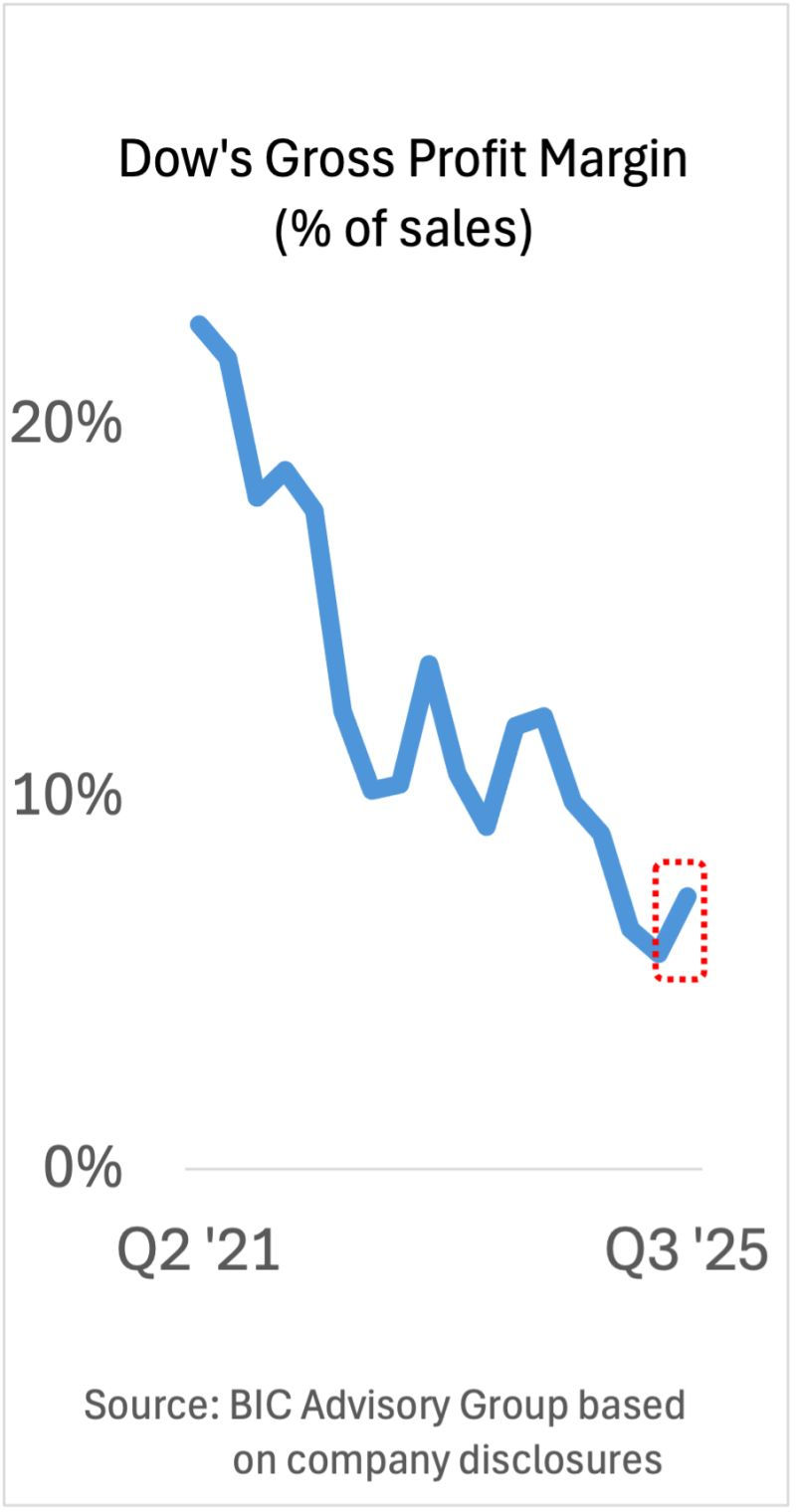

📊 Squeezed margins — Global oversupply is weighing on earnings (see recent BIC Advisory Group analysis in chart), making financing new projects even harder.

Meanwhile, China is doubling down on its polymer self-sufficiency drive, and the Middle East is locking in outlets for its oil and gas via petrochemicals.

⚖️ What This Means:

It may sound bleak, but it’s not all doom and gloom:

💵 Existing North American assets will remain highly profitable, monetizing their feedstock advantage.

💤 New NA large-scale cracker projects are unlikely for the next several years.

With Europe’s chemical industry in a structural decline, it will be “All Quiet on the Western Front” for new cracker investments.

What is your take? Who are the winners and losers from this NA investment cooling-off period?

Comments