🇧🇷 From Shock Duties to Market Rebalance

- Emma Bassila

- Dec 18, 2025

- 1 min read

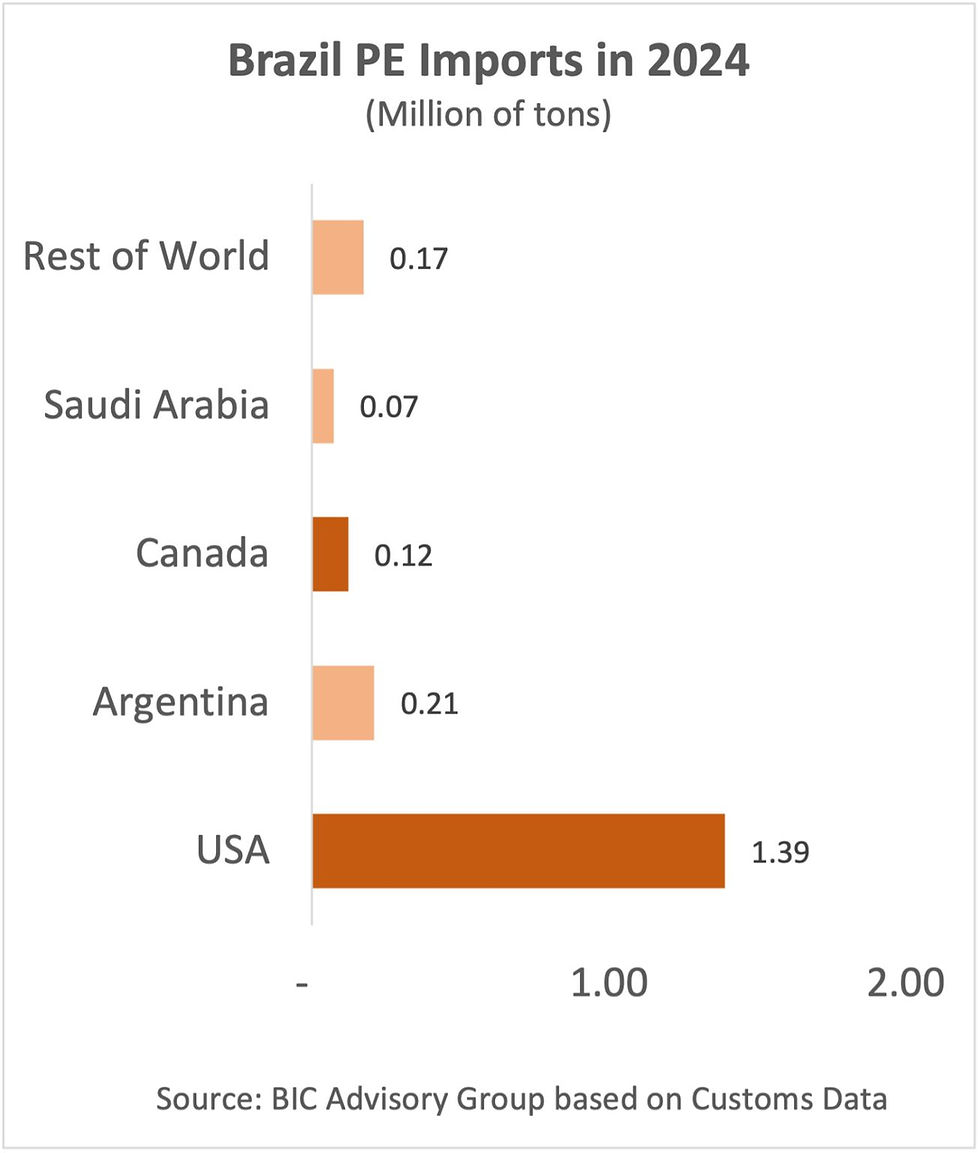

Brazil’s new 9–11 c/lb anti-dumping duties on U.S. & Canadian PE have traders on edge. It sounds like a game-changer — but the reality is more predictable: global trade flows will absorb the shock, just like they always do.

🔎 Fresh analysis from BIC Advisory Group’s released on September 1 in an Executive Brief to clients shows:

Braskem gets a ~$225M short-term uplift in profitability.

CANUSA PE exports to Brazil don’t “go to zero” — they’ll reroute. First to China, then rebalance into Europe & Africa.

Saudi resin gains an edge into Brazil, but freight costs erode part of that advantage.

Panic = discounts. Discipline = opportunity.

Bottom line: This too will pass and in short order. For disciplined players, the volatility creates entry points, not exits.

💡 That’s the perspective BIC Advisory Group clients count on: cutting through headlines, spotting the over-reaction, and finding the real signal.

What’s your view — short-term noise, or a longer-term reset in PE trade?

Comments