🇰🇷 Seoul Just Blinked: Is This the First Real Sign of a Chemical Market Reset?

- Emma Bassila

- Dec 18, 2025

- 1 min read

The big news out of Seoul last week caught many by surprise:

👉 Ten petrochemical companies have agreed to restructure, cutting 2.7–3.7 million tons of ethylene capacity (plus derivatives).

This isn’t the first time Korea has gone big on restructuring. Back in 1999, during the Asian financial crisis, government-led consolidation reshaped the industry. The difference today? No financial crisis in sight, just a profitability crisis driven by chronic overcapacity and squeezed margins.

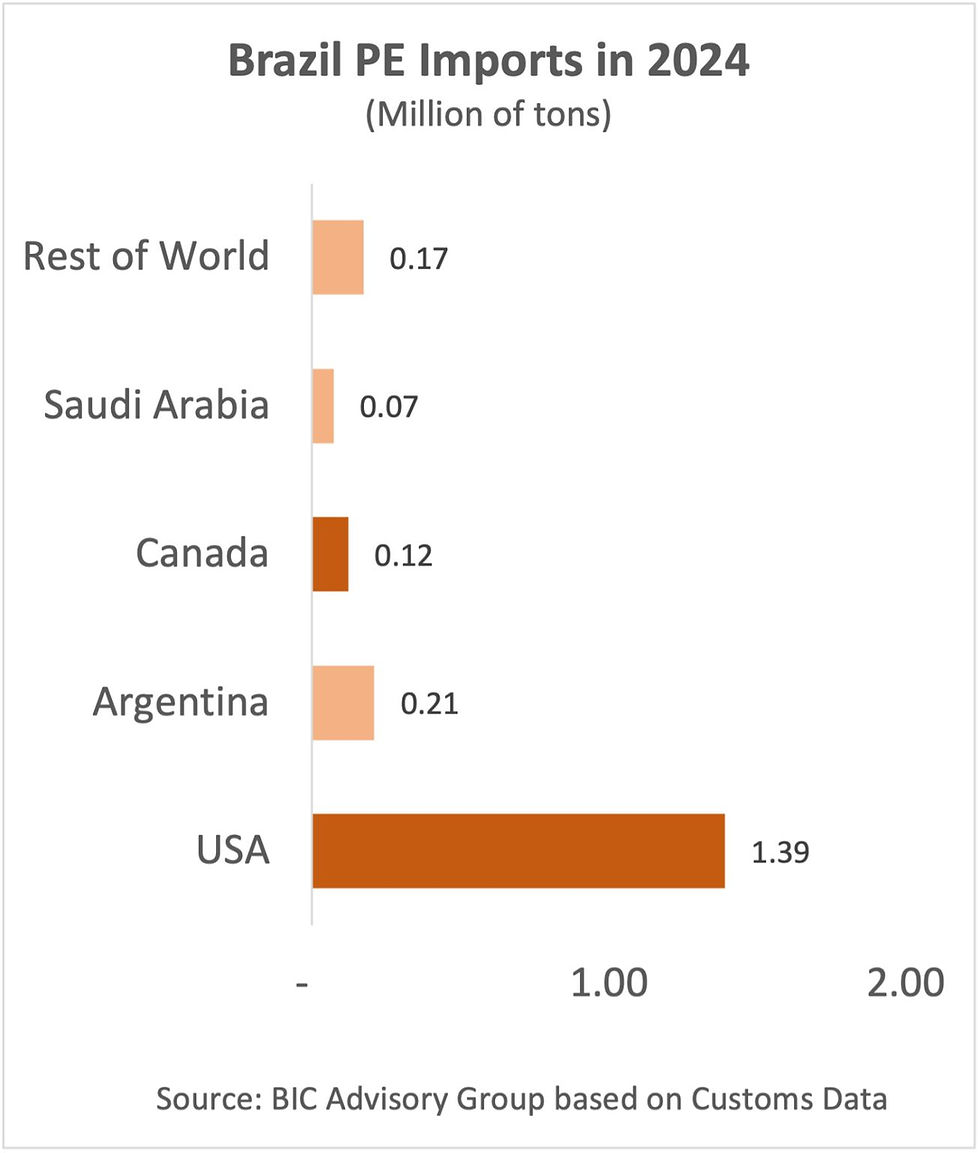

🔎 To understand the move, look at Korea’s export model:

· Buy expensive naphtha from the Middle East

· Crack it into ethylene in Korea

· Export polyethylene (PE) to all corners of the world

That means high feedstock costs + high logistics costs = a very tough business model.

The numbers tell the story (per BIC Advisory Group analysis):

SK to China: 1.7 Mta of PE exports—but China is rapidly moving toward polyolefin self-sufficiency.

SK to Rest of World outside Asia: 0.9 Mta of exports—where logistics are prohibitive.

So while shutting down ~3.7 Mt of ethylene is “only” ~10% of the global overcapacity problem, it might still mark a turning point in the bottoming process.

💡 The question for the industry:

a) Is this a small but significant step—another domino falling toward balance?

b) Or is it too small to matter—a nothing-burger in the face of massive oversupply?

What’s your take? Is it a) or b)?

Comments