Want to Disrupt the Global PE Trade? You’ll Need More Than Tariffs.

- sleimanbassila

- Aug 14, 2025

- 2 min read

Updated: Dec 18, 2025

Understanding the Current Landscape of PE Exports

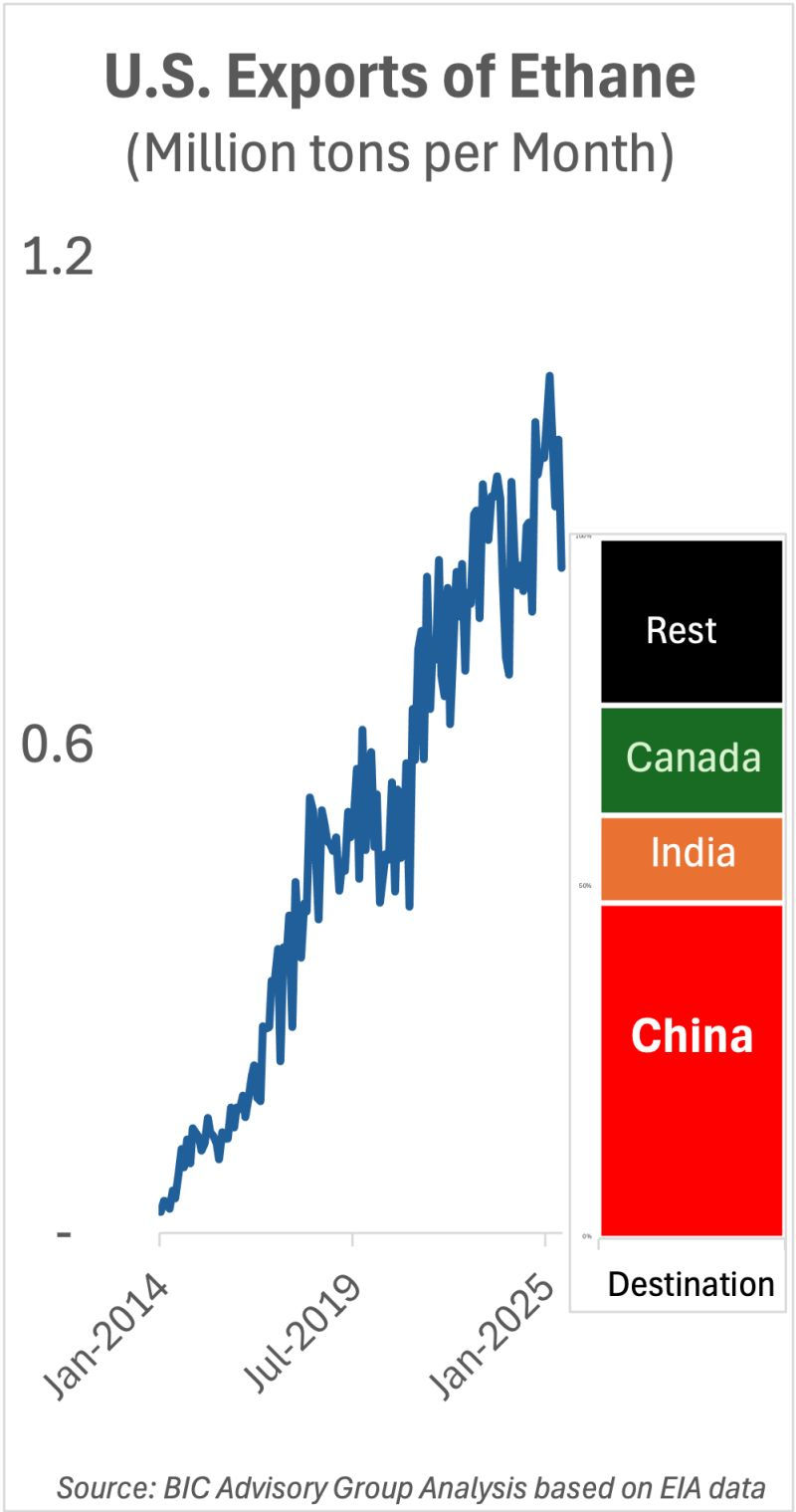

📊 Fresh analysis from BIC Advisory Group shows that US maritime polyethylene (PE) exports rose 4.8% year-over-year in the first half of 2025 — even as tariff debates dominated the news cycle.

The regional picture tells the real story:

🌍 Africa: +47% — the fastest-growing import region for US PE.

🌎 Europe: +16% — a healthy rebound despite policy uncertainty.

🌏 Asia: –8% — April’s US–China trade paralysis is still evident.

The Resilience of US PE Exports

Why the resilience? BIC Advisory Group’s analysis points to a structural driver: the US holds a 3:1 feedstock cost advantage over many importing regions. Even tariffs of 15–30% can’t wipe out that competitive edge.

So the real strategic question isn’t whether tariffs matter; it’s:

💬 How high would they need to climb to actually shift global PE trade flows?

And what other forces could tip the balance?

The Role of Feedstock Costs

Feedstock costs play a crucial role in the competitiveness of polyethylene. When we talk about feedstock, we refer to the raw materials used to produce PE. In the US, the abundance of natural gas and other resources gives us a significant edge. This advantage allows US producers to offer lower prices, even when tariffs are applied.

Imagine trying to sell a product that costs you significantly more to produce than your competitor. It’s a tough position. However, with the right resources, you can maintain a competitive price point. This is exactly what the US is doing in the PE market.

Tariffs: A Double-Edged Sword

While tariffs can protect domestic industries, they can also lead to unintended consequences. For instance, higher tariffs on imported PE could drive up prices. This might seem beneficial for local producers in the short term, but it could also lead to reduced demand.

Consider this: if prices rise too high, customers may seek alternatives. They might turn to other materials or suppliers. Therefore, while tariffs are a tool, they are not a silver bullet.

The Future of Global PE Trade

As we look ahead, the question remains: what will shape the future of global PE trade? Factors such as technological advancements, environmental regulations, and shifts in consumer preferences will all play significant roles.

For example, the push for sustainable materials is gaining momentum. Companies are exploring bio-based and recycled options. This shift could redefine the competitive landscape.

Conclusion: A Holistic Approach to Competitiveness

To truly disrupt the global PE trade, businesses must adopt a holistic approach. This means looking beyond tariffs and considering all the factors that influence competitiveness.

By leveraging data-driven insights, companies can make smarter decisions. They can identify opportunities for growth and innovation.

At BIC Advisory Group, we aim to be your trusted advisor in navigating these complexities. We are here to help you boost your competitiveness and increase profits by making informed decisions.

What do you think? Are tariffs the answer, or is there more to the story?

Comments