Will tariffs crush the North American Polyethylene (PE) production rates?

- Emma Bassila

- Jun 13, 2025

- 1 min read

Short Answer: NO

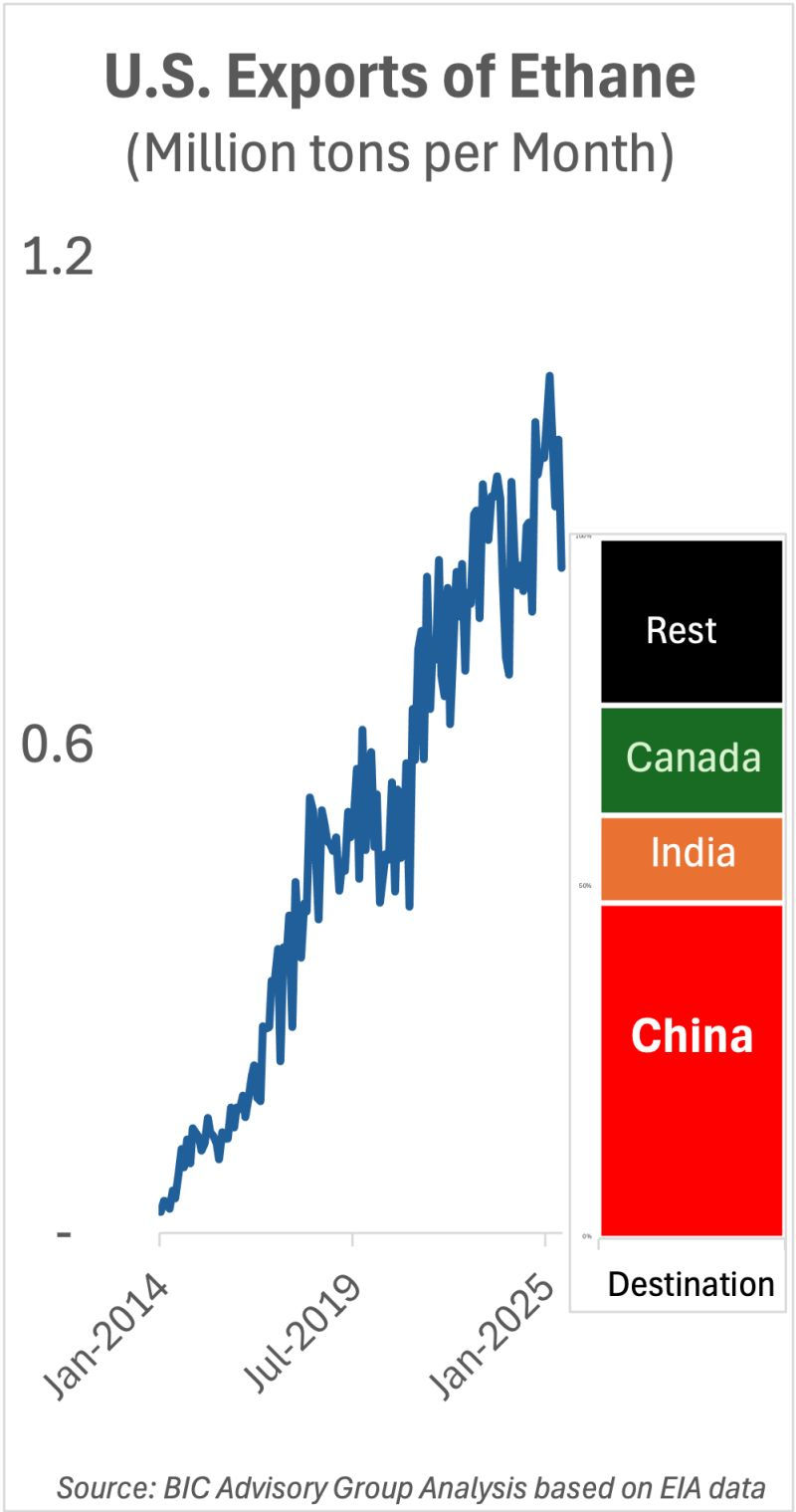

Long Story: In spite of the announced tariffs and counter-tariffs, North American polyethylene resin producers still enjoy enough of a feedstock advantage (ethane cracking advantage vs naphtha cracking) to be able to run full and export to the world their production that is in excess of domestic demand.

With what is announced to date, only China is becoming cost prohibitive (after tariffs) for the US exporters. However, US exports to China account for (only) ~ 2.5 million tons per year (Mta) and this is less than 5% of total PE traded globally estimated at 56 Mta by BIC Advisory Group (chart below). Therefore, the US resin exporters will be able to pivot away from China and find a home for all their North American production. So, given the relative size of the disrupted route, there are enough degrees of freedom in the global PE supply chain to allow for this adjustment.

So why the panic? Two reasons:

1) Confusion reigns supreme in a world of policy by tweet!

2) It will take a few months for exporters to re-jig their PE supply chains away from the US-to-China lane. Once they do, nerves will calm down as there will be confirmation that the world did not come to an abrupt end 🤔 .

Call BIC Advisory Group for a detailed analysis of tariff related trade disruptions.

Comments