🔻 Hold ’Em or Fold ’Em? A Strategic Question for Europe’s Chemical Industry Executives 🔻

- Emma Bassila

- Jul 15, 2025

- 1 min read

Updated: Dec 18, 2025

We’re witnessing a wave of chemical plant closures across Europe. For executives navigating this bottom-of-cycle environment—marked by subdued demand and global overcapacity—a critical question must be asked:

👉 Is the European chemical industry structurally viable, or is it time to start reallocating capital elsewhere?

In oversupplied commodity markets, cost leadership isn’t optional—it’s existential. That leadership hinges on two pillars:

1. Feedstock Advantage – competitively priced inputs reduce production cost.

2. Proximity to Growth Markets – shortens supply chains and reduces tariff risk.

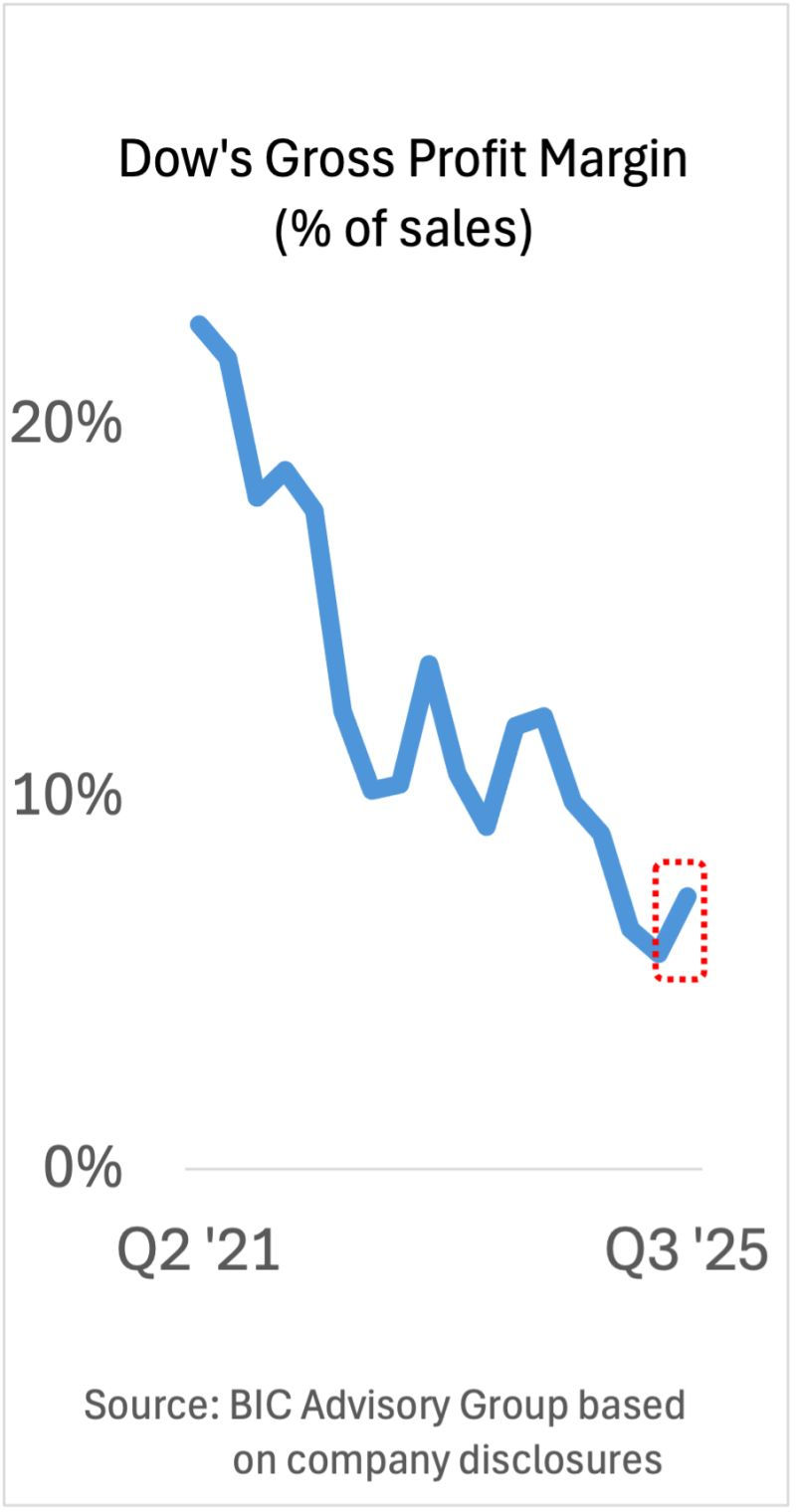

Europe fails on both counts as visualized by BIC Advisory group chart below.

Add high electricity and labor costs, and the competitive gap widens even further.

David Ricardo, the 19th-century economist, would suggest a clear path forward: reallocate resources to where Europe has a comparative advantage. That might mean exiting base chemicals and investing where returns are more sustainable.

But as every executive knows, exiting a legacy industry isn’t easy. There are:

Capital write-downs

Social impacts

Political pressures

Still, the choice remains: take the hit upfront or bleed slowly over many years.

💬 What’s your view? Should Europe’s chemical industry double down and consolidate, or begin an orderly exit from legacy commodities?

Let’s connect if you’re weighing these questions inside your organization. This is a moment for decisive strategy, not incremental drift.

Comments